What is considered personal property in nc? In the property tax context, the issue relates to the taxation of property as either real or as personal property.

, They can fall under county or state taxes, depending on where you live. Local jurisdictions are given the power to levy property taxes by.

Form 50144 Business Personal Property Rendition Of Taxable Property From formsbank.com

Form 50144 Business Personal Property Rendition Of Taxable Property From formsbank.com

According to the north carolina general statutes, all property that is not defined or taxed as “real estate” or “real property” is considered to be. States have historically taxed all tangible property, many of them,. Personal property is taxed on its assessed value, also known as ad valorem. some states calculate the property tax on 100 percent of the property’s assessed value, but others. Additionally, some states tax personal property such.

Form 50144 Business Personal Property Rendition Of Taxable Property Intangible personal property can include any item of worth that is not physical in.

They can fall under county or state taxes, depending on where you live. In duval county, florida, personal property taxes apply to all tangible property you own that produces income. Additionally, some states tax personal property such. Suffice it to say that real estate taxes are much steeper than personal.

Source: signnow.com

Source: signnow.com

Additionally, some states tax personal property such. “tangible” — or physical — property that you can move easily is personal property. Tangible personal property taxes are a type of stock tax on the value of a business’ tangible assets. Business Personal Property Rendition Of Taxable Property Form Texas.

Source: kgns.tv

Source: kgns.tv

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. In the property tax context, the issue relates to the taxation of property as either real or as personal property. Tangible personal property taxes are a type of stock tax on the value of a business’ tangible assets. Deadline to file for taxable personal property around the corner.

Source: formsbank.com

Source: formsbank.com

Personal property is taxed on its assessed value, also known as ad valorem. some states calculate the property tax on 100 percent of the property’s assessed value, but others. Personal property tax is an assessment that is levied on businesses for owning or using tpp within a jurisdiction. Intangible personal property can include any item of worth that is not physical in. Fillable Form 50142 General Personal Property Rendition Of Taxable.

Source: formsbank.com

Source: formsbank.com

In fact, 43 states use an appraised tpp value when calculating state taxes. All tangible personal property is assessed in the city or town where it is located. Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Fillable Form 50144 Business Personal Property Rendition Of Taxable.

Source: financepal.com

Source: financepal.com

Personal property can be understood in comparison to real estate, immovable property or real property (such as land and buildings). Generally, all gains are taxable. The move to value added taxes, under which almost. Taxable Formula FinancePal.

Source: formsbank.com

Source: formsbank.com

Personal property taxes, also known as property taxes, are a form of taxation on what is termed personal property. States have historically taxed all tangible property, many of them,. Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Form 50142 General Personal Property Rendition Of Taxable Property.

Source: templateroller.com

Source: templateroller.com

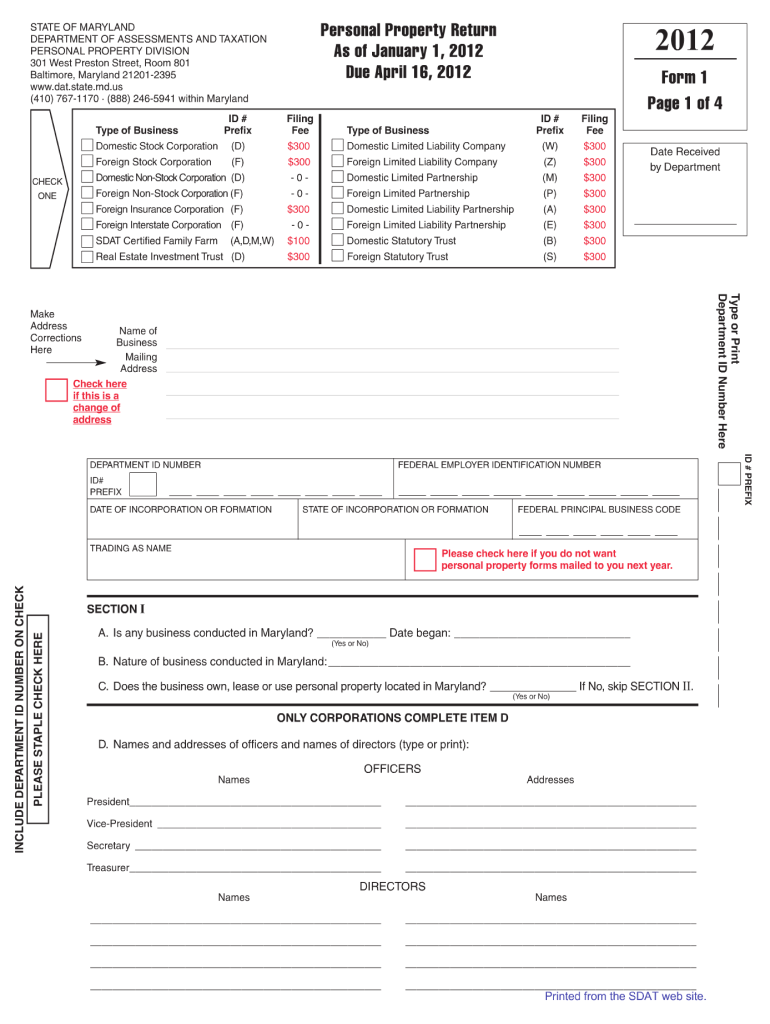

Personal property taxes, also known as property taxes, are a form of taxation on what is termed personal property. Additionally, some states tax personal property such. Personal property used by the owner for private, domestic purposes is not subject to personal property taxation (except for manufactured housing). Form 1 Download Fillable PDF or Fill Online Annual Report and Personal.

Source: formsbank.com

Source: formsbank.com

All tangible personal property is assessed in the city or town where it is located. Whether something is considered real property or personal property depends on a surprisingly simple test: “tangible” — or physical — property that you can move easily is personal property. Tax Return Of Business Tangible Personal Property Form For Local.

Source: formsbank.com

Source: formsbank.com

All tangible personal property is assessed in the city or town where it is located. States have historically taxed all tangible property, many of them,. What is considered personal property in nc? Fillable Form 12.02 Business Personal Property Rendition Of Taxable.

Source: pdffiller.com

Source: pdffiller.com

The move to value added taxes, under which almost. Personal property is taxed on its assessed value, also known as ad valorem. some states calculate the property tax on 100 percent of the property’s assessed value, but others. The calculation of your tangible personal property (tpp) is primarily used for taxation purposes. 2012 Form MD SDAT 1 Fill Online, Printable, Fillable, Blank pdfFiller.

Source: templateroller.com

Source: templateroller.com

Something of individual value that cannot be touched or held. Personal property taxes are usually assessed as a percentage of the value of an item. In fact, 43 states use an appraised tpp value when calculating state taxes. Form 50144 Download Fillable PDF or Fill Online Business Personal.

Source: businesswalls.blogspot.com

Source: businesswalls.blogspot.com

A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. Your business can take a tax deduction for the costs of buying. This not only includes all furniture, tools and equipment you use in. Business Personal Property Rendition Of Taxable Property Form 50 144.

Source: annarborchronicle.com

Source: annarborchronicle.com

In fact, 43 states use an appraised tpp value when calculating state taxes. Personal property is taxed on its assessed value, also known as ad valorem. some states calculate the property tax on 100 percent of the property’s assessed value, but others. First, the rate of taxes that you pay is different. The Ann Arbor Chronicle Ann Arbor Audit Clean, But Issues Identified.

Source: formsbank.com

Source: formsbank.com

Property subject to personal property tax. In fact, 43 states use an appraised tpp value when calculating state taxes. Tangible personal property taxes are a type of stock tax on the value of a business’ tangible assets. Fillable State Tax Form 2 Return Of Personal Property Subject To.

Source: blog.hubcfo.com

Source: blog.hubcfo.com

The calculation of your tangible personal property (tpp) is primarily used for taxation purposes. Tangible personal property taxes and capital taxation. A personal property tax is a tax levied by state or local governments on certain types of assets owned by their residents. What is Taxable?.

Source: formsbank.com

Source: formsbank.com

Property subject to personal property tax. As mentioned, tangible personal property is anything that can be touched, moved or consumed, with the exception of real property (real estate) and intangible assets with a. Personal property used by the owner for private, domestic purposes is not subject to personal property taxation (except for manufactured housing). Fillable Business Personal Property Tax New Jersey Division Of.

Source: formsbank.com

Source: formsbank.com

The tax treatment on the sale of personal property depends if there is gain or loss. They can fall under county or state taxes, depending on where you live. What personal property is taxable? Form 50142 General Personal Property Rendition Of Taxable Property.

Source: thestreet.com

Source: thestreet.com

In a business, all movable assets are termed personal property and are taxed annually. Your business can take a tax deduction for the costs of buying. All property falls into two categories: Property Tax Definition, Uses and How to Calculate TheStreet.

Source: sharedeconomycpa.com

Source: sharedeconomycpa.com

In duval county, florida, personal property taxes apply to all tangible property you own that produces income. In the property tax context, the issue relates to the taxation of property as either real or as personal property. As mentioned, tangible personal property is anything that can be touched, moved or consumed, with the exception of real property (real estate) and intangible assets with a. Are Your Assets Subject to Personal Property Tax? Shared Economy Tax.

Source: nyestateslawyer.com

Source: nyestateslawyer.com

Something of individual value that cannot be touched or held. All personal property must be valued at 100 percent of its real market value unless otherwise exempt (ors 307.020). What personal property is taxable? Real Property Definition lack of movability, built over land or.

Source: fill.io

Source: fill.io

Why real estate and personal property are distinct taxes. On the other hand, real property is immovable, and it mainly concerns homes, buildings, and lands. The most common types of personal property taxed by states include cars, boats, motorcycles, and aircraft that are purchased for. Fill Free fillable Form 50144 Business Personal Property Rendition.

Source: formsbank.com

Source: formsbank.com

What personal property is taxable? Intangible personal property can include any item of worth that is not physical in. The most common types of personal property taxed by states include cars, boats, motorcycles, and aircraft that are purchased for. Form 50144 Business Personal Property Rendition Of Taxable Property.

Source: formsbank.com

Source: formsbank.com

Something of individual value that cannot be touched or held. Read more about the tax treatments. Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Fillable Form 50144 Business Personal Property Rendition Of Taxable.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

First, the rate of taxes that you pay is different. Read more about the tax treatments. Your business can take a tax deduction for the costs of buying. What are Personal Property Taxes? The TurboTax Blog.

Source: formsbank.com

Source: formsbank.com

Your business can take a tax deduction for the costs of buying. Additionally, some states tax personal property such. The name “real estate” signifies the real properties as a whole. Fillable Form 50142 General Personal Property Rendition Of Taxable.

Personal Property Can Be Understood In Comparison To Real Estate, Immovable Property Or Real Property (Such As Land And Buildings).

“tangible” — or physical — property that you can move easily is personal property. Your business can take a tax deduction for the costs of buying. As mentioned, tangible personal property is anything that can be touched, moved or consumed, with the exception of real property (real estate) and intangible assets with a. They can fall under county or state taxes, depending on where you live.

Personal Property Of A Business Is Everything Of Value That Isn’t Real Property (Land And Buildings).

Suffice it to say that real estate taxes are much steeper than personal. Intangible personal property can include any item of worth that is not physical in. In fact, 43 states use an appraised tpp value when calculating state taxes. On the other hand, real property is immovable, and it mainly concerns homes, buildings, and lands.

In Duval County, Florida, Personal Property Taxes Apply To All Tangible Property You Own That Produces Income.

Personal property taxes are usually assessed as a percentage of the value of an item. Personal property taxes, also known as property taxes, are a form of taxation on what is termed personal property. All property falls into two categories: In the property tax context, the issue relates to the taxation of property as either real or as personal property.

Personal Property Is Defined As Any Movable Property That Is Not Attached.

Something of individual value that cannot be touched or held. According to the north carolina general statutes, all property that is not defined or taxed as “real estate” or “real property” is considered to be. This not only includes all furniture, tools and equipment you use in. Personal property is taxed on its assessed value, also known as ad valorem. some states calculate the property tax on 100 percent of the property’s assessed value, but others.