Learn more and get quotes at auto insurance matchup. The average cost of car insurance in indiana is $1,219, but your rates may be higher or lower depending on a number of factors,.

, Learn more and get quotes at auto insurance matchup. That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in.

Compare Nissan Pathfinder Insurance Rate Quotes in Fort Wayne Indiana From fortwayneinsure.com

Compare Nissan Pathfinder Insurance Rate Quotes in Fort Wayne Indiana From fortwayneinsure.com

Required minimum indiana car insurance coverage. Drivers in indiana are required to have the following car insurance coverage: $25,000 property damage per accident. In some cases, additional coverages were added.

Compare Nissan Pathfinder Insurance Rate Quotes in Fort Wayne Indiana How much car insurance you need in indiana is the first question to consider.

Drivers in indiana are required to have the following car insurance coverage: In some cases, additional coverages were added. To meet indiana�s minimum requirements, indiana drivers should make sure that their car insurance policies include: 6 essential tips for first time drivers;

Source: insuredasap.com

Source: insuredasap.com

An application for a license issued by the indiana secretary of state, auto dealer services division must be accompanied by evidence of liability insurance covering the established place. What are the minimum limits for indiana? The average cost of car insurance in indiana is $1,219, but your rates may be higher or lower depending on a number of factors,. A Guide To Reinstate Your Suspended License Plates in Illinois.

Source: valuepenguin.com

Source: valuepenguin.com

An application for a license issued by the indiana secretary of state, auto dealer services division must be accompanied by evidence of liability insurance covering the established place. Indiana requires the same 25/50/25 minimums for uninsured and underinsured motorist coverage, unless you reject it in writing. With one dui on your driving record, the average cost of a car insurance policy in indiana is $1,855, according to our research. Safe Auto Insurance Auto Insurance Company Review ValuePenguin.

Source: rodneyshannon.sfagentjobs.com

Source: rodneyshannon.sfagentjobs.com

The average cost of car insurance in indiana is $1,219, but your rates may be higher or lower depending on a number of factors,. Car insurance limits in indiana. The bare minimum car insurance requirement for indiana drivers is: Staff Assistant State Farm Agent Team Member (Bilingual Spanish.

Source: coverage.com

Source: coverage.com

$50,000 bodily injury per accident. What are the minimum limits for indiana? The cheapest car insurance company is state farm, with. Best car insurance companies in Indiana.

Indiana’s law mandates that motorists must have the minimum liability insurance protection as follows:. 6 essential tips for first time drivers; Coverage limits refer to the minimum amount of insurance the state mandates drivers carry in order to legally drive. Indiana Sr22 Insurance Quotes.

Source: thehartford.com

Source: thehartford.com

$25,000 property damage per accident. Each newly written indiana auto liability policy must include uninsured and underinsured motorist’s coverage unless you reject this in writing. The bare minimum car insurance requirement for indiana drivers is: No Fault Insurance What Is No Fault Insurance? PIP The Hartford.

Source: paperless-insurance.com

Source: paperless-insurance.com

Indiana law requires all drivers to carry a minimum amount of liability coverage car insurance. Indiana car insurance laws require all drivers to carry auto insurance when driving or parking on public roads. The minimum insurance limits required by the state of indiana can be seen below: States Allowing Electronic Proof of Auto Insurance Business Insurance.

Source: qualitycontactsolutions.com

Source: qualitycontactsolutions.com

Despite indiana’s minimum coverage requirements, people without car insurance hit the road every day. Minimum liability car insurance in indiana. With one dui on your driving record, the average cost of a car insurance policy in indiana is $1,855, according to our research. Indiana Telemarketer Registration Update QCS.

Source: hollydays.info

Source: hollydays.info

The cheapest car insurance company is state farm, with. You are required to have the following coverage as part of your indiana auto insurance policy: Bodily injury to others, property damage, uninsured motorist bodily injury, uninsured property damage, and. ACORD 140 FILLABLE PDF.

Source: fortwayneinsure.com

Source: fortwayneinsure.com

With one dui on your driving record, the average cost of a car insurance policy in indiana is $1,855, according to our research. Bodily injury to others, property damage, uninsured motorist bodily injury, uninsured property damage, and. An application for a license issued by the indiana secretary of state, auto dealer services division must be accompanied by evidence of liability insurance covering the established place. Fort Wayne Indiana Jaguar XType Insurance Rates.

Source: carinsurancelist.com

Source: carinsurancelist.com

Drivers in indiana must also have proof of insurance on their person. That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in. In order to comply with indiana�s motor vehicle financial responsibility laws, drivers are usually required to carry liability car insurance. Car Insurance in Indiana.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

The average cost of car insurance in indiana is $1,219, but your rates may be higher or lower depending on a number of factors,. That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in. To meet indiana�s minimum requirements, indiana drivers should make sure that their car insurance policies include: Indiana Auto Insurance.

Source: insurancelawhelp.com

Source: insurancelawhelp.com

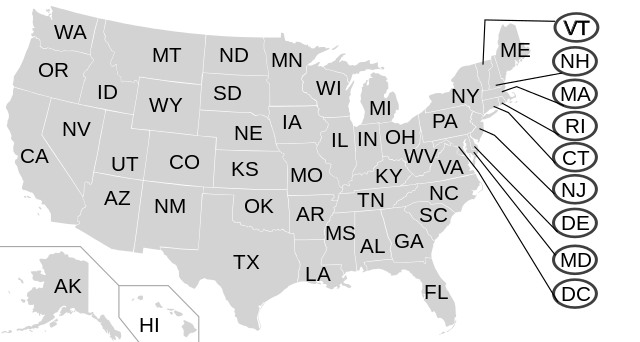

How much car insurance you need in indiana is the first question to consider. Drivers in indiana are required to have the following car insurance coverage: To meet indiana�s minimum requirements, indiana drivers should make sure that their car insurance policies include: What Is The Minimum Liability Auto Insurance Coverage in Your State And.

In order to comply with indiana�s motor vehicle financial responsibility laws, drivers are usually required to carry liability car insurance. $25,000 bodily injury per person. $50,000 bodily injury per accident. How To Register A Car In Nc Online How to Register a Vehicle After.

Source: mugundesign.blogspot.com

Source: mugundesign.blogspot.com

Each newly written indiana auto liability policy must include uninsured and underinsured motorist’s coverage unless you reject this in writing. $25,000 bodily injury per person. Indiana car insurance laws require all drivers to carry auto insurance when driving or parking on public roads. Which State Has The Cheapest Car Insurance Rates mugundesign.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Required minimum indiana car insurance coverage. The minimum insurance limits required by the state of indiana can be seen below: You are required to have the following coverage as part of your indiana auto insurance policy: Car Insurance Policy Number On Card news word.

Source: drifted.com

Source: drifted.com

Indiana car insurance laws require bodily injury liability coverage of $25,000 per person and $50,000 per accident, along with $25,000 of property damage liability coverage. Coverage limits refer to the minimum amount of insurance the state mandates drivers carry in order to legally drive. $25,000 for bodily injury per person. Types Of Car Insurance In The USA.

Source: moneybeagle.com

Source: moneybeagle.com

Minimum liability car insurance in indiana. With one dui on your driving record, the average cost of a car insurance policy in indiana is $1,855, according to our research. However, it will also leave you at risk. Cheapest Auto Insurance Salt Creek Commons IN Near Me + 2.

That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in. Drivers in indiana are required to have the following car insurance coverage: Indiana car insurance laws require bodily injury liability coverage of $25,000 per person and $50,000 per accident, along with $25,000 of property damage liability coverage. Car Insurance in Fort Wayne, Indiana Everything You Need To Know.

Source: fortwayneinsure.com

Source: fortwayneinsure.com

$50,000 bodily injury per accident. Bodily injury to others, property damage, uninsured motorist bodily injury, uninsured property damage, and. $25,000 bodily injury per person per accident. Compare Nissan Pathfinder Insurance Rate Quotes in Fort Wayne Indiana.

Source: bergstrominsurance.net

Source: bergstrominsurance.net

An application for a license issued by the indiana secretary of state, auto dealer services division must be accompanied by evidence of liability insurance covering the established place. $50,000 bodily injury for all persons per accident. To meet indiana�s minimum requirements, indiana drivers should make sure that their car insurance policies include: Bergstrom Insurance Lafayette, Indiana Featuring Progressive.

Source: insurify.com

Source: insurify.com

Indiana car insurance laws require all drivers to carry auto insurance when driving or parking on public roads. Indiana law requires that all car owners and drivers prove their continuous financial responsibility by maintaining certain levels of auto insurance. $25,000 for bodily injury per person. GAINSCO Car Insurance Quotes, Features Insurify®.

Source: hensleylegal.com

Source: hensleylegal.com

$25,000 property damage per accident. 6 essential tips for first time drivers; That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in. 4 Types of Indiana Car Insurance You Should Carry Hensley Legal Group, PC.

Indiana car insurance laws require bodily injury liability coverage of $25,000 per person and $50,000 per accident, along with $25,000 of property damage liability coverage. This helps cover your expenses if you�re in an accident caused by. How much car insurance you need in indiana is the first question to consider. Indiana State Minimum Insurance Limits / All States Car Insurance.

Source: policygenius.com

Source: policygenius.com

Drivers in indiana must also have proof of insurance on their person. $25,000 property damage per accident. $50,000 bodily injury per accident. Car Insurance Statistics In 2021 Policygenius.

With One Dui On Your Driving Record, The Average Cost Of A Car Insurance Policy In Indiana Is $1,855, According To Our Research.

Indiana law requires all drivers to carry a minimum amount of liability coverage car insurance. Indiana car insurance regulations require all drivers to maintain minimum coverage of 25/50/10 in liability insurance when operating their vehicles. Indiana requires the same 25/50/25 minimums for uninsured and underinsured motorist coverage, unless you reject it in writing. Indiana auto insurance online, indiana auto insurance plan, auto insurance quotes indiana, cheap indiana auto insurance, indiana auto insurance requirements, car insurance indiana, auto.

Minimum Liability Car Insurance In Indiana.

The minimum insurance limits required by the state of indiana can be seen below: 6 essential tips for first time drivers; Indiana law requires that all car owners and drivers prove their continuous financial responsibility by maintaining certain levels of auto insurance. From an insurance point of view, limits.

In Order To Comply With Indiana�s Motor Vehicle Financial Responsibility Laws, Drivers Are Usually Required To Carry Liability Car Insurance.

That’s why it’s a smart idea to purchase uninsured motorist (um) coverage in. Coverage limits refer to the minimum amount of insurance the state mandates drivers carry in order to legally drive. Indiana car insurance laws require bodily injury liability coverage of $25,000 per person and $50,000 per accident, along with $25,000 of property damage liability coverage. $25,000 bodily injury per person.

An Application For A License Issued By The Indiana Secretary Of State, Auto Dealer Services Division Must Be Accompanied By Evidence Of Liability Insurance Covering The Established Place.

$50,000 bodily injury per accident. Indiana’s law mandates that motorists must have the minimum liability insurance protection as follows:. Drivers in indiana must also have proof of insurance on their person. In some cases, additional coverages were added.