Personal umbrella insurance does not cover damage to the insured’s property. What exactly does umbrella insurance cover?

, What does umbrella insurance cover. This is because umbrella insurance provides coverage beyond the limits of your other insurance policies, and things like.

Beginners Guide to Umbrella Insurance Graybeal Group, Inc. From graybealgroup.com

Beginners Guide to Umbrella Insurance Graybeal Group, Inc. From graybealgroup.com

As a landlord, you are responsible or the health and safety of your tenants and their. However, there are some limitations to this coverage. Generally, these are homeowners, auto. However, all policies will protect you financially in liability claims, including:

Beginners Guide to Umbrella Insurance Graybeal Group, Inc. Umbrella insurance is a form of liability coverage, and there are things a personal umbrella policy won’t cover, such as:

Umbrella insurance will cover property damage in most but not all circumstances. As a landlord, you are responsible or the health and safety of your tenants and their. People who are at higher risk of accidents. Umbrella insurance is a type of personal liability insurance that covers costs that exceed the limits of your underlying insurance policies.

Umbrella insurance is a personal liability policy that adds excess liability coverage if you’re found liable for property damage or bodily injury, and the costs exceed the limits of your. Umbrella insurance offers an additional layer of liability protection. Umbrella insurance is a form of liability coverage, and there are things a personal umbrella policy won’t cover, such as: Does An Umbrella Policy Cover Property Damage STAETI.

Source: abercorninsurance.com

Umbrella insurance is a great investment for landlords with one or many rental properties. What does umbrella insurance cover? Umbrella insurance offers an additional layer of liability protection. Umbrella Insurance Receive Extra Protection In Savannah Abercorn.

Source: farmers.com

Source: farmers.com

Umbrella insurance policy is the extra liability insurance as the primary role is to cover liabilities that the existing policy can�t/don�t cover. For example, an umbrella policy can provide for:. What does umbrella insurance cover. What Does an Umbrella Insurance Policy Cover? Farmers Insurance®.

Source: ciginsurance.com

Source: ciginsurance.com

Umbrella policies cover the cost of damaged property that exceeds your homeowners or auto policy limits. Personal umbrella insurance does not cover damage to the insured’s property. What exactly does umbrella insurance cover? Umbrella Coverage 101 Capital Insurance Group.

Source: grahaminsuranceinc.com

Source: grahaminsuranceinc.com

What does umbrella insurance cover. Depending on the insurer, you may be able. For instance, to add umbrella coverage to your car insurance, your policy may need to have $300,000 of bodily injury liability coverage and $100,000 of property damage liability coverage. Personal Umbrella Insurance Graham Insurance Inc..

Source: proinsgrp.com

Source: proinsgrp.com

It offers bodily injury and property. However, all policies will protect you financially in liability claims, including: However, there are some limitations to this coverage. Commercial Umbrella Insurance Pro Insurance Group.

Source: 123insurancevt.com

Source: 123insurancevt.com

Umbrella insurance can provide coverage for injuries, property damage, certain lawsuits, and personal liability situations. As a landlord, you are responsible or the health and safety of your tenants and their. What does personal umbrella insurance cover? Umbrella Insurance 123 Insurance.

Source: propalliance.com

Source: propalliance.com

Depending on the insurer, you may be able. How does an umbrella insurance policy work? Yes, umbrella insurance does cover property damage. The Difference Between Homeowner�s & Landlord Insurance.

Source: rockfordmutual.com

Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage. Personal umbrella insurance covers a range of potential liabilities, including those that may arise from accidents, injuries, and. Liability insurance helps cover your financial responsibility for injury to others and damage to their property. Understanding Umbrella Insurance Rockford Mutual Insurance Company.

Source: gooddayinsurance.com

Source: gooddayinsurance.com

We all know accidents happen, and you never know how extensive the property damage can be. In no way does an umbrella policy. People who are at higher risk of accidents. Personal Umbrella Gooddayinsurance.

Source: graybealgroup.com

Source: graybealgroup.com

Your personal umbrella insurance policy does not. For example, an umbrella policy can provide for:. Umbrella insurance may be the answer. Beginners Guide to Umbrella Insurance Graybeal Group, Inc..

Source: hutzlerlaw.com

Source: hutzlerlaw.com

What does umbrella insurance cover. Additionally, many umbrella policies cover. If your pli maxes out but claims or judgments remain for injuries or property damage, umbrella insurance can cover the balance. What Does Umbrella Coverage Mean and Do I Need It?.

Source: spillmanhendersoninsurance.com

Source: spillmanhendersoninsurance.com

What does umbrella insurance cover? People who are at higher risk of accidents. Umbrella insurance may be the answer. Personal Umbrella Policy What do they really cover Spillman.

Source: blog.insurethelake.com

Source: blog.insurethelake.com

Liability insurance helps cover your financial responsibility for injury to others and damage to their property. Umbrella insurance will cover property damage in most but not all circumstances. Home and auto insurance are designed to cover property damage to the insured home and vehicle, as well as provide liability coverage —. Insure the Lake Steve Naught Is Umbrella Insurance Necessary?.

Source: contentsoil.com

Source: contentsoil.com

They help protect assets and, as such,. Umbrella insurance is a great investment for landlords with one or many rental properties. Personal umbrella insurance covers a range of potential liabilities, including those that may arise from accidents, injuries, and. What is Umbrella Insurance? Know everything About Umbrella Insurance.

Source: catawbavalleyinsurance.com

Source: catawbavalleyinsurance.com

What does personal umbrella insurance cover? Yes, umbrella insurance does cover property damage. As a homeowner, you may have someone visiting your home. Don�t Your Umbrella! Catawba Valley Insurance Agency Hickory.

Source: profrty.blogspot.com

Source: profrty.blogspot.com

An umbrella policy will usually cover bodily injury, personal injury, property damage and landlord liability. Umbrella insurance policy is the extra liability insurance as the primary role is to cover liabilities that the existing policy can�t/don�t cover. In a homeowners insurance policy, bodily injury coverage helps pay for lawsuits brought by people injured on your property and in your home. Do Umbrella Policies Cover Property Damage PROFRTY.

Source: duduborgesoficial.blogspot.com

Source: duduborgesoficial.blogspot.com

Liability insurance helps cover your financial responsibility for injury to others and damage to their property. For instance, to add umbrella coverage to your car insurance, your policy may need to have $300,000 of bodily injury liability coverage and $100,000 of property damage liability coverage. Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage. How Much Umbrella Insurance What Is an Umbrella Policy? How often.

Source: dorchesterinsurance.ca

Source: dorchesterinsurance.ca

Umbrella insurance offers an additional layer of liability protection. Umbrella insurance coverage provides an extra boost of protection, above and beyond the existing limits of other policies. Personal umbrella insurance also will not cover intentional acts, criminal behavior,. What Does an Umbrella Policy Cover? Dorchester Insurance.

Source: ssfcu.org

Source: ssfcu.org

It does not cover damage to our own property or any liability related to your business. They help protect assets and, as such,. Yes, umbrella insurance does cover property damage. Umbrella Security Service.

Source: joywallet.com

Source: joywallet.com

How does an umbrella insurance policy work? Your personal umbrella insurance policy does not. Yes, umbrella insurance does cover property damage. Umbrella Insurance What It Is and How Much You Need.

Source: slideserve.com

Source: slideserve.com

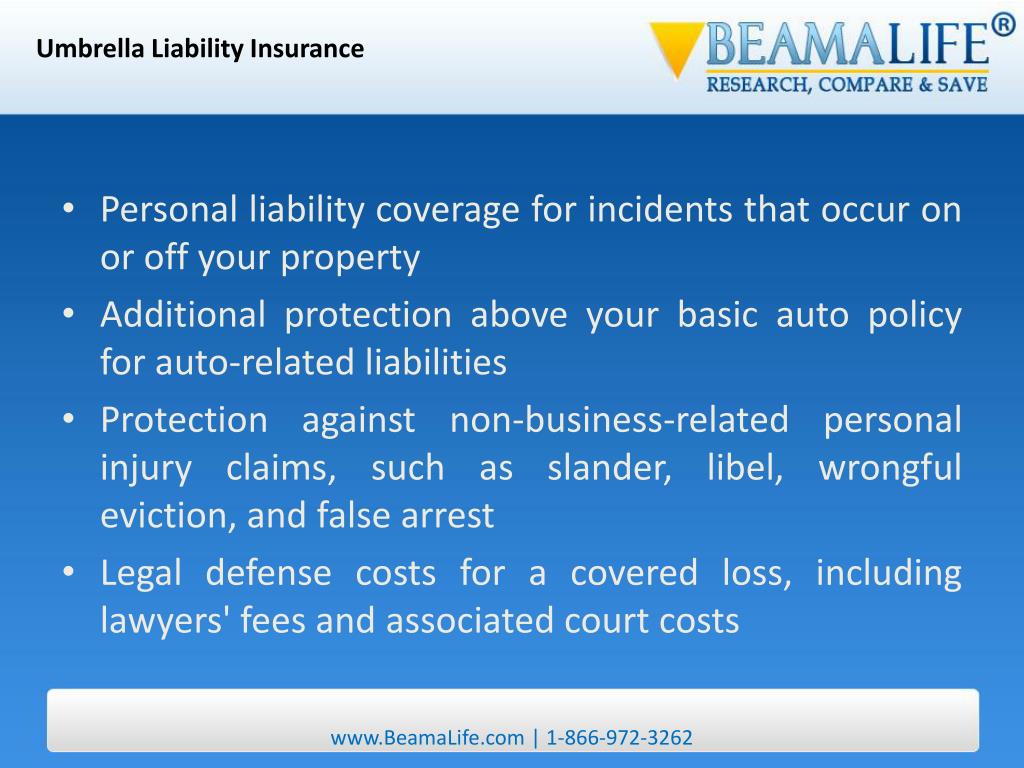

Every umbrella insurance policy is slightly different. Umbrella insurance is a great investment for landlords with one or many rental properties. Damage to your own property: PPT Umbrella Liability Insurance PowerPoint Presentation, free.

Source: slideserve.com

Source: slideserve.com

In a homeowners insurance policy, bodily injury coverage helps pay for lawsuits brought by people injured on your property and in your home. However, all policies will protect you financially in liability claims, including: What exactly does umbrella insurance cover? PPT Umbrella Liability Insurance PowerPoint Presentation, free.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Umbrella insurance is a personal liability policy that adds excess liability coverage if you’re found liable for property damage or bodily injury, and the costs exceed the limits of your. Depending on the insurer, you may be able. Umbrella insurance offers an additional layer of liability protection. What Is Umbrella Insurance For Business Insurance Reference.

Source: allstate.com

Source: allstate.com

This type of policy is meant to protect from liability claims. Umbrella policies cover the cost of damaged property that exceeds your homeowners or auto policy limits. Umbrella insurance policy is the extra liability insurance as the primary role is to cover liabilities that the existing policy can�t/don�t cover. What Does a Personal Umbrella Policy Cover? Allstate.

What Exactly Does Umbrella Insurance Cover?

Umbrella insurance is a personal liability policy that adds excess liability coverage if you’re found liable for property damage or bodily injury, and the costs exceed the limits of your. What does umbrella insurance cover. As a landlord, you are responsible or the health and safety of your tenants and their. Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage.

Umbrella Insurance Offers An Additional Layer Of Liability Protection.

Personal umbrella insurance does not cover damage to the insured’s property. Umbrella insurance policy is the extra liability insurance as the primary role is to cover liabilities that the existing policy can�t/don�t cover. Usually, a $1 million umbrella policy costs between $150 and $300 per year. Generally, these are homeowners, auto.

People Who Are At Higher Risk Of Accidents.

In no way does an umbrella policy. Every umbrella insurance policy is slightly different. Additionally, many umbrella policies cover. If they slip and fall, you could be held liable for their injuries and any other damages.

They Help Protect Assets And, As Such,.

What does umbrella insurance cover? Your personal umbrella insurance policy does not. If your pli maxes out but claims or judgments remain for injuries or property damage, umbrella insurance can cover the balance. We all know accidents happen, and you never know how extensive the property damage can be.