Travelers, a provider of umbrella insurance, lists items generally covered in an. Personal umbrella insurance also will not cover intentional acts,.

, The contractor also purchases a commercial umbrella insurance policy to cover an. It covers what primary policies do not cover based on.

Umbrella Insurance Personal Umbrella Insurance Policies Heacock From heacock.com

Umbrella Insurance Personal Umbrella Insurance Policies Heacock From heacock.com

If you are found at fault, the remainder of umbrella coverage not used for defense costs may. An umbrella policy typically offers: That coverage is in addition to. Personal umbrella insurance also will not cover intentional acts,.

Umbrella Insurance Personal Umbrella Insurance Policies Heacock An umbrella policy typically offers:

Umbrella insurance costs roughly $150 to $300 a year, for the first $1 million of coverage and an additional $50 to $75 per year for higher. $1 million to $10 million of liability, which can help protect assets such as your home, car and boat. $1 and $5 million coverage limits. Excess liability insurance isn’t expensive at all.

Source: famousspanginsurance.com

Source: famousspanginsurance.com

Additionally, your umbrella policy may cover your attorney. Personal umbrella insurance also will not cover intentional acts,. An extra $1 million to $10 million of liability coverage, which can help protect assets such as your home, car and boat. Umbrella Insurance Coverage Famous & Spang Insurance.

Source: theagentinsurance.com

Source: theagentinsurance.com

Florida umbrella insurance typically covers the following types of claims for any person who is covered under. For instance, if your attorney’s fees amount to $200,000 and you have a $1,000,000 umbrella insurance policy, you only have $800,000 worth of coverage left. Legal fees can add up. The Agent Guide to Umbrella Insurance The Agent Insurance.

Source: thetysonagency.com

Source: thetysonagency.com

An umbrella insurance can provide: $1 million to $10 million of liability, which can help protect assets such as your home, car and boat. Umbrella policies are commonly available from insurers that also sell auto, home and watercraft insurance. Umbrella Insurance in PA The Tyson Agency.

Source: axiomadvisory.com

Source: axiomadvisory.com

If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners’ insurance does not. Umbrella policies will cover what your primary home and auto insurance excludes or will provide. Personal umbrella coverage is an excess coverage that doesn’t cost much at all. Services — Axiom Advisory LLC.

Source: splittergewitter.blogspot.com

Source: splittergewitter.blogspot.com

Coverage limits start at $1 million for personal umbrella insurance to cover liabilities, attorney fees, and other expenses associated with a claim against you and the. What does umbrella insurance cover? If their medical bills total $300,000 and exceed the $250,000 that your auto insurance policy covers, your umbrella insurance policy will kick in to cover the difference, plus. How Much Umbrella Insurance Do I Need.

Source: minespress.com

Source: minespress.com

An extra $1 million to $10 million of liability coverage, which can help protect assets such as your home, car and boat. Umbrella policies are commonly available from insurers that also sell auto, home and watercraft insurance. That coverage is in addition to. Umbrella Insurance Brochure Mines Press.

Source: kydexowbholsters.com

Source: kydexowbholsters.com

Personal umbrella insurance also will not cover intentional acts,. If you are found at fault, the remainder of umbrella coverage not used for defense costs may. $1 and $5 million coverage limits. Is USCCA a Scam? Get a USCCA Membership.

Source: patbennerinsurance.com

Source: patbennerinsurance.com

What does umbrella insurance cover? Personal injury coverage for claims such as libel, slander, defamation of character and invasion of privacy. Personal umbrella insurance also will not cover intentional acts,. Personal Umbrella Pat Benner.

Source: slideserve.com

Source: slideserve.com

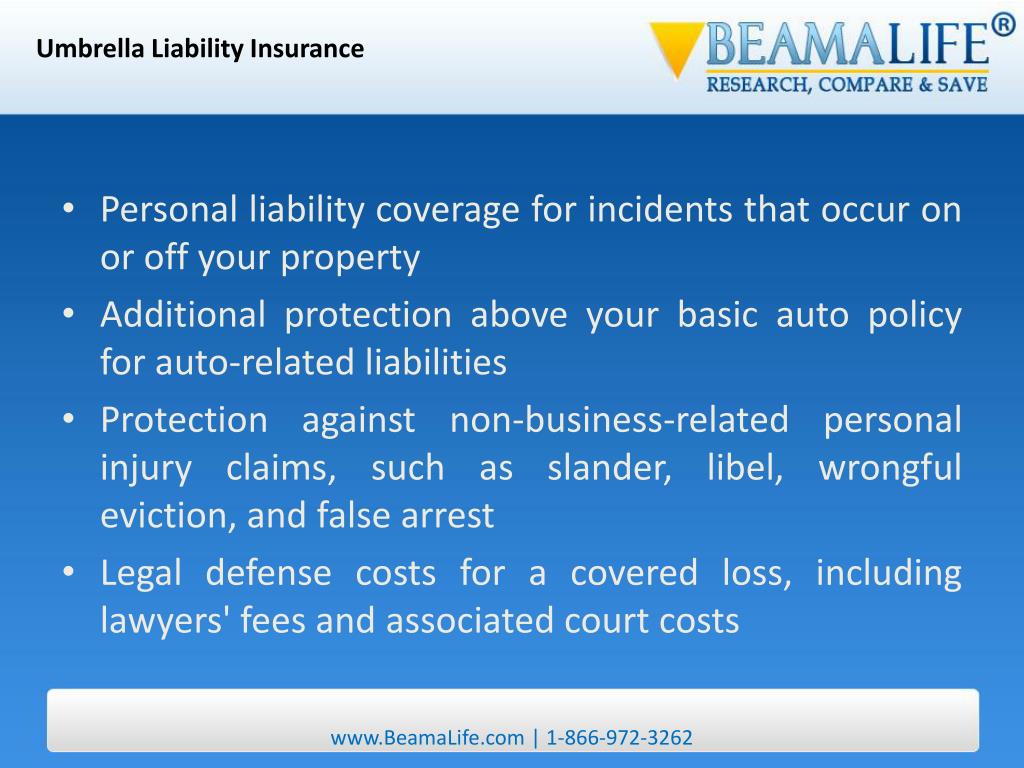

Umbrella policies are commonly available from insurers that also sell auto, home and watercraft insurance. Umbrella insurance offers the advantage of extending the liability protection on your home and auto policies. According to the insurance information institute, an umbrella insurance policy with $1 million covers costs between $150 and $300 per year. PPT Umbrella Liability Insurance PowerPoint Presentation, free.

Source: libertytitle.com

Source: libertytitle.com

Most homeowner�s insurance policies give coverage for specific sorts of losses. An umbrella insurance can provide: The contractor also purchases a commercial umbrella insurance policy to cover an. Umbrella by Liberty Title Liberty Title.

Source: tricorpinsurance.com

Source: tricorpinsurance.com

If their medical bills total $300,000 and exceed the $250,000 that your auto insurance policy covers, your umbrella insurance policy will kick in to cover the difference, plus. Personal injury coverage for claims such as libel, slander, defamation of character and invasion of privacy. You can buy umbrella liability policies in. ABC Auto and Tricorp, LTD Umbrella Insurance in Jacksonville, NC.

Source: honigconte.com

Source: honigconte.com

Insurance companies often attempt to restrict coverage to. Personal umbrella insurance also will not cover intentional acts,. Travelers, a provider of umbrella insurance, lists items generally covered in an. Commercial Umbrella Insurance New York Business Insurance HCP.

Personal injury coverage for claims such as libel, slander, defamation of character and invasion of privacy. Most homeowner�s insurance policies give coverage for specific sorts of losses. Personal umbrella coverage is an excess coverage that doesn’t cost much at all. How Much Umbrella Insurance Do I Need.

Source: msipa.com

Source: msipa.com

$1 and $5 million coverage limits. If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners’ insurance does not. Umbrella insurance costs roughly $150 to $300 a year, for the first $1 million of coverage and an additional $50 to $75 per year for higher. Umbrella Insurance Coverage Marthinsen & Salvitti Insurance Group.

Source: heacock.com

Source: heacock.com

That coverage is in addition to. According to the insurance information institute, an umbrella insurance policy with $1 million covers costs between $150 and $300 per year. If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners’ insurance does not. Umbrella Insurance Personal Umbrella Insurance Policies Heacock.

Source: kpigroup.net

Source: kpigroup.net

If you are found at fault, the remainder of umbrella coverage not used for defense costs may. A general contractor buys employers’ liability insurance with a limit of $1 million. If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners’ insurance does not. Commercial Umbrella Insurance Kansas Preferred Insurance Group.

Source: grahaminsuranceinc.com

Source: grahaminsuranceinc.com

For instance, if your attorney’s fees amount to $200,000 and you have a $1,000,000 umbrella insurance policy, you only have $800,000 worth of coverage left. In a recent case out of florida’s fifth district court of appeal, the court held that attorney’s fees awarded to a plaintiff in a construction defect action against an insured contractor were. Claims for dog bites are usually covered by insurance. Personal Umbrella Insurance Graham Insurance Inc..

Source: brookswaterburn.com

Source: brookswaterburn.com

Most homeowner�s insurance policies give coverage for specific sorts of losses. According to the insurance information institute, an umbrella insurance policy with $1 million covers costs between $150 and $300 per year. Umbrella policies are commonly available from insurers that also sell auto, home and watercraft insurance. New York Umbrella Insurance.

Source: eigcorporations.com

Source: eigcorporations.com

The umbrella policy will also cover any attorney fees and other expenses related to the lawsuit that weren’t covered by your homeowner�s policy. Personal umbrella insurance also will not cover intentional acts,. What does umbrella insurance cover? Home and Auto.

Source: carriepolkagency.com

Source: carriepolkagency.com

Claims that are frequently covered. Coverage for claims like libel,. An umbrella policy can provide two types of coverage: Umbrella Insurance Carrie Polk Insurance Inc..

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

If their medical bills total $300,000 and exceed the $250,000 that your auto insurance policy covers, your umbrella insurance policy will kick in to cover the difference, plus. Travelers umbrella insurance can help provide coverage for: Excess liability insurance isn’t expensive at all. Travelers Umbrella Insurance / Protect What S Important With A.

Source: calroseins.com

Source: calroseins.com

Personal umbrella coverage is an excess coverage that doesn’t cost much at all. Insurance companies often attempt to restrict coverage to. For instance, to add umbrella coverage to your car insurance, your policy may need to have $300,000 of bodily injury liability coverage and $100,000 of property damage liability coverage. Umbrella Insurance Calrose Insurance Everett, WA.

Source: brazosinsuranceagency.com

Source: brazosinsuranceagency.com

Travelers umbrella insurance can help provide coverage for: Additionally, your umbrella policy may cover your attorney. What does umbrella insurance cover? Sugar Land Commercial Umbrella Insurance Business Umbrella Liability.

Source: laporteinsuranceagency.com

Source: laporteinsuranceagency.com

An umbrella policy typically offers: An extra $1 million to $10 million of liability coverage, which can help protect assets such as your home, car and boat. A general contractor buys employers’ liability insurance with a limit of $1 million. Commercial Umbrella Insurance 101 La Poarte Insurance.

Source: famousspanginsurance.com

Source: famousspanginsurance.com

Personal umbrella insurance also will not cover intentional acts,. In a recent case out of florida’s fifth district court of appeal, the court held that attorney’s fees awarded to a plaintiff in a construction defect action against an insured contractor were. An umbrella policy can provide two types of coverage: Umbrella Insurance Coverage Famous & Spang Insurance.

Claims That Are Frequently Covered.

An umbrella policy typically offers: Travelers, a provider of umbrella insurance, lists items generally covered in an. Personal umbrella insurance also will not cover intentional acts,. Personal injury coverage for claims such as libel, slander, defamation of character and invasion of privacy.

That Coverage Is In Addition To.

Travelers umbrella insurance can help provide coverage for: Umbrella insurance costs roughly $150 to $300 a year, for the first $1 million of coverage and an additional $50 to $75 per year for higher. For instance, if your attorney’s fees amount to $200,000 and you have a $1,000,000 umbrella insurance policy, you only have $800,000 worth of coverage left. Florida umbrella insurance typically covers the following types of claims for any person who is covered under.

Coverage Limits Start At $1 Million For Personal Umbrella Insurance To Cover Liabilities, Attorney Fees, And Other Expenses Associated With A Claim Against You And The.

According to the insurance information institute, an umbrella insurance policy with $1 million covers costs between $150 and $300 per year. A general contractor buys employers’ liability insurance with a limit of $1 million. You can buy umbrella liability policies in. Claims for dog bites are usually covered by insurance.

An Umbrella Insurance Can Provide:

Most homeowner�s insurance policies give coverage for specific sorts of losses. If you had a $1 million umbrella policy, your umbrella insurance would cover what your homeowners’ insurance does not. It covers what primary policies do not cover based on. $1 million to $10 million of liability, which can help protect assets such as your home, car and boat.